Introduction

In 2025, the world of cryptocurrency is no longer limited to just Bitcoin and Ethereum. One of the most revolutionary trends gaining momentum is DeFi, or Decentralized Finance. DeFi is changing how we borrow, lend, save, and invest money by removing the need for banks and traditional financial institutions. In this beginner-friendly guide, we’ll explore what DeFi is, how it works, why it matters, and what you should know before investing in the future of finance.

What is DeFi?

DeFi stands for Decentralized Finance , a new financial system built on blockchain technology. Unlike traditional finance, which relies on banks, DeFi uses smart contracts on blockchains like Ethereum to perform financial transactions. This means users can access loans, earn interest, trade assets, and more — all without a middleman.

In 2025, understanding what DeFi is has become essential for anyone interested in the future of money. DeFi platforms are transparent, open to everyone, and run on code rather than people or corporations.

How DeFi Works

DeFi works by using smart contracts — self-executing pieces of code stored on a blockchain. These contracts handle everything from loan agreements to trades automatically. If you’re wondering what DeFi is and how it can replace banks, the answer lies in these smart contracts.

For example, if you want to lend your crypto on a DeFi platform, a smart contract ensures you earn interest without needing a bank to manage the process. Everything is controlled by algorithms and recorded on the blockchain.

Key Features of DeFi

To fully understand what DeFi is, let’s look at some of its core features:

- Decentralization – No single authority controls the system.

- Permissionless – Anyone with a crypto wallet can access DeFi platforms.

- Transparency – All transactions are recorded on a public blockchain.

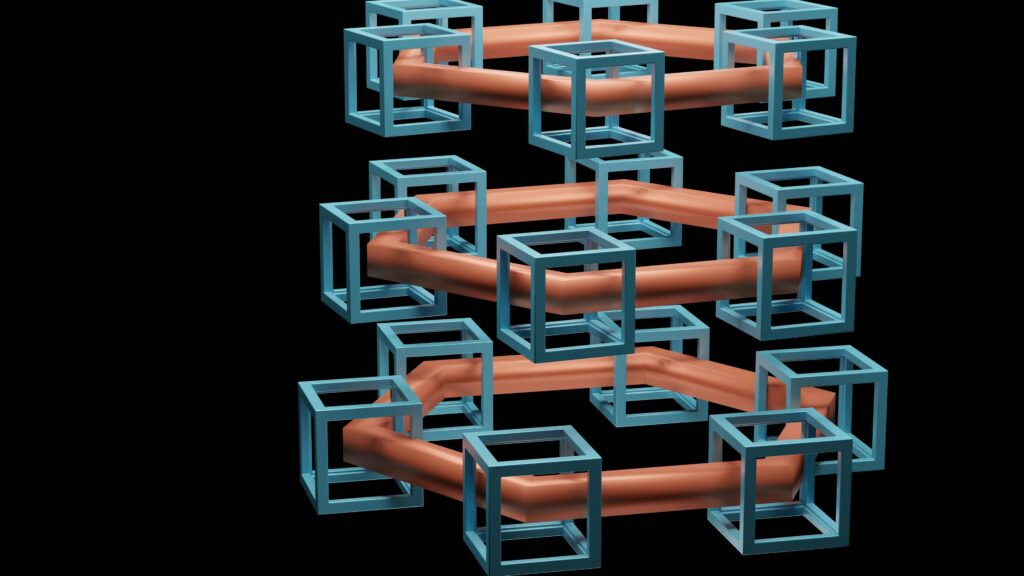

- Interoperability – DeFi apps (also called dApps) can connect with each other.

- Self-Custody – Users control their funds directly.

These features are redefining the financial world, making what DeFi is more relevant than ever in 2025.

Common DeFi Use Cases

Understanding what DeFi is becomes easier when you explore its real-world applications. Here are some popular DeFi services:

1. Lending and Borrowing

DeFi platforms like Aave and Compound allow users to lend their crypto and earn interest. Borrowers can access loans by providing crypto collateral.

2. Decentralized Exchanges (DEXs)

DEXs like Uniswap let users trade crypto directly with each other, without intermediaries.

3. Stablecoins

Stablecoins are cryptocurrencies pegged to fiat money like the USD. They provide price stability and are widely used in DeFi.

4. Yield Farming

Yield farming involves earning rewards by staking or lending crypto. It’s a way to maximize returns on your assets.

5. Insurance

DeFi insurance protocols protect users from risks like smart contract bugs or hacks.

These examples help illustrate what DeFi is and how it’s already providing alternatives to traditional banking services.

Benefits of DeFi

The growing popularity of DeFi in 2025 is due to its powerful advantages:

- No Middlemen: You don’t need to trust banks or brokers.

- Global Access: Anyone with internet can participate.

- High Yields: DeFi often offers better returns than traditional savings.

- Innovation: Rapid development of new financial products.

All of these benefits make it clear what DeFi is and why it’s being called the future of finance.

Risks and Challenges

Despite its promise, what DeFi is also includes certain risks:

- Smart Contract Bugs: Coding errors can lead to lost funds.

- Scams and Rug Pulls: Some DeFi projects are fake or unsustainable.

- Volatility: Crypto markets are highly unpredictable.

- Regulatory Uncertainty: Governments are still figuring out how to regulate DeFi.

Anyone curious about what DeFi is must consider both the opportunities and the dangers before diving in.

DeFi vs Traditional Finance

One way to understand what DeFi is involves comparing it with the traditional financial system:

| Feature | Traditional Finance | DeFi |

|---|---|---|

| Control | Centralized (banks) | Decentralized (blockchain) |

| Accessibility | Limited (KYC, location) | Global & permissionless |

| Transparency | Opaque systems | Fully transparent |

| Speed | Slow (days) | Fast (minutes or seconds) |

| Fees | High | Often lower |

As the table shows, knowing what DeFi is reveals a future financial model that could be faster, fairer, and more efficient.

The Future of DeFi

In 2025 and beyond, what DeFi is will continue to evolve. Developers are building more scalable, secure, and user-friendly DeFi platforms. Integration with traditional finance is also increasing, which may lead to hybrid systems.

We can also expect:

- Improved regulation that protects users

- DeFi services on multiple blockchains (like Solana, Avalanche, and Polygon)

- Growth of institutional interest in DeFi

These developments show that what DeFi is today might just be the beginning of something much bigger.

Conclusion

By now, you should have a clear understanding of what DeFi is and why it’s gaining popularity in 2025. From lending and borrowing to trading and earning, DeFi is reshaping the financial system. While it comes with risks, its benefits are too big to ignore. If you’re ready to take control of your money and explore a more open financial world, it’s time to dive into what DeFi is and embrace the future of finance.

Q1: Is DeFi safe to use?

A: DeFi can be safe if you use trusted platforms and understand the risks. However, there’s always the chance of bugs or scams.

Q2: Can I earn passive income with DeFi?

A: Yes, lending, staking, and yield farming are common ways to earn passive income in DeFi.

Q3: Do I need to complete KYC to use DeFi?

A: Most DeFi platforms are permissionless and don’t require identity verification.

Q4: Is DeFi legal?

A: DeFi is legal in most countries, but regulations are still developing. Always follow local laws.

Q5: How do I start using DeFi?

A: You’ll need a crypto wallet like MetaMask and some cryptocurrency to interact with DeFi platforms.

READ ALSO : Crypto Taxes Explained – How to Legally Save on Taxes in 2025