CRCL stock is generating a lot of buzz, and for good reason. CRCL is situated at the nexus of stablecoin innovation and digital finance infrastructure, supported by the strength of Circle Internet Group. Circle’s IPO may herald the next major wave of fintech investment in a financial industry that is moving toward digital currencies and blockchain-based systems.

What, then, attracts fintech followers, cryptocurrency aficionados, and institutional investors to Circle Internet Group stock?

Let’s break it down.

🔍 What Is CRCL Stock?

The term “CRCL stock” describes shares of Circle Internet Group, a financial technology company based in the United States that gained notoriety for creating USD Coin (USDC), one of the most popular stablecoins in the world. The company went public to expand its reach into regulated financial services while further developing blockchain-based payment infrastructure.

USDC is backed 1:1 by the U.S. dollar and operates as a regulated stablecoin, making it more trustworthy to financial institutions, credit card companies, and everyday crypto investors compared to more volatile digital currencies.

🏦 Who Is Circle Internet Group?

Since its founding in 2013, Circle Internet Group has developed into one of the most significant businesses in the blockchain space. Making money flow as freely, transparently, and effectively as internet data is their goal. Stablecoins like USDC can help with that.

They’ve partnered with major players including:

- Visa

- BlackRock

- Coinbase

- U.S. regulators and banks

These collaborations make Circle Internet Group stock a top watch in the current cryptocurrency market.

📈 Is CRCL Stock a Good Investment in 2025?

CRCL provides investors with a unique chance to invest in a company that connects traditional finance and cryptocurrency as interest in stablecoins grows. Circle is essential as regulations tighten, blockchain technology becomes more widely used, and peer-to-peer digital transactions increase globally.

Key investment highlights:

- USDC market cap remains one of the highest among stablecoins

- Growing adoption in payment methods and cryptocurrency transactions

- CRCL may benefit from upcoming fiat currency digitization

- Circle’s open-source infrastructure is gaining traction globally

However, investing in cryptocurrency or related stocks is not without risk. As always, diversification is key when managing financial assets.

💲 Circle and Stablecoin Regulation: A U.S. Advantage?

Circle’s compliance-first strategy is one of its greatest advantages. Circle has embraced U.S. regulation, in contrast to many other cryptocurrency startups. As the government seeks to standardize stablecoin operations within the banking system, this could pay off in 2025.

In comparison to rivals that function outside of regulatory frameworks, CRCL stock may have a strong position due to their leadership in compliance.

📊 What Drives the Value of CRCL Stock?

The performance of CRCL stock is closely tied to:

- USDC adoption rates

- Stablecoin volume on exchanges

- Blockchain and fintech partnerships

- Regulatory clarity from the Federal Reserve and SEC

- Market demand for crypto-integrated payment methods

In other words, as stablecoin usage grows, so may Circle Internet Group stock.

🔮 The Future of Circle Internet Group

Circle isn’t just about one product. In the coming years, they plan to:

- Expand USDC onto more blockchains

- Improve cross-border settlement with distributed ledger technology

- Create financial products for institutional investing in cryptocurrency

- Offer enhanced APIs for businesses accepting digital currency payments

All of this could fuel long-term growth and brand trust — which is essential for investors.

📉 CRCL vs. Traditional Financial Stocks

The value of CRCL is independent of lending and interest rates, in contrast to banks or credit card companies. Rather, it thrives on peer-to-peer transactions, blockchain technology, and processing power. As a result, it might be more resilient during rate hikes or even during a recession.

That said, the price of CRCL stock can still be influenced by:

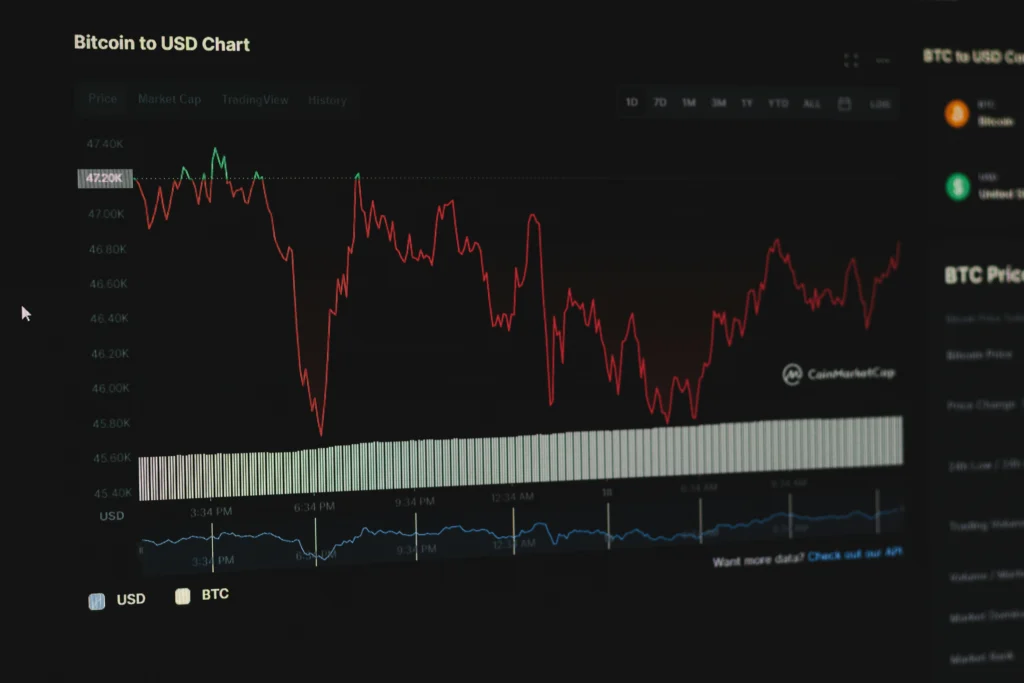

- Crypto volatility

- Regulatory uncertainty

- Competition from other stablecoin providers (like PayPal USD or Tether)

Bonus Tips for CRCL Investors

- Keep an eye on FOMC news because Fed policy and rate decisions can impact investor perceptions of fintech.

- Monitor USDC adoption as a crucial predictor of Circle’s future expansion.

- Diversify your holdings; don’t depend just on stocks linked to stablecoins or CRCL.

- Follow stablecoin legislation — It could change everything for Circle’s business model.

Circle Internet Group: What is it?

A fintech company based in the United States that specializes in developing global financial services using stablecoins, open-source technology, and blockchain.

How does Circle generate revenue?

USDC transactions, institutional services, API access, and alliances with banks and platforms are how Circle makes money.

How does regulation affect CRCL stock?

Circle’s compliance with U.S. regulation could make it a safer long-term play than other crypto firms.

CRCL stock: what is it?

Circle Internet Group, the organization that created the USDC stablecoin and blockchain-based financial infrastructure, is represented by the stock ticker CRCL.

Is it wise to invest in CRCL stock?

If regulation favors compliant providers, CRCL may offer long-term potential for investors who are optimistic about stablecoins and digital finance.

READ ALSO :

Federal Reserve Interest Rates: What’s Next After the Fed Meeting?

Can Anyone Get the Amex Platinum Card? What You Should Know

👤 Author Bio Box

Written by the Swipywiro Team

Swipywiro.com is a U.S.-focused blog delivering the latest updates on crypto, stocks, digital finance, and Web3 investing. Connect with us on Twitter @swipywiro.

⚠️ Financial Disclaimer

This article is for informational purposes only and does not constitute financial advice. Always consult with a licensed financial advisor before making investment decisions. Swipywiro.com does not hold responsibility for any financial losses incurred.